ohio unemployment income tax refund

The Ohio Department of Taxation provides a tool that allows you to check the status of your income tax refund online. Due to the Federal American Rescue Plan Act of 2021 signed into law on March.

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

In all about 13 million taxpayers may be eligible for a federal tax deduction on last years jobless benefits according to the IRS.

. You can also call the departments individual taxpayer. If you received unemployment benefits in 2020 a tax refund may be on its way to you. On April 6 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update.

Due to the Federal American Rescue Plan Act of 2021 signed into law on March. Due to the Federal American Rescue Plan Act of 2021 signed into law on March. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits.

Used by employers to authorize someone. The Ohio Department of Taxation provides a tool that allows you to check the status of your income tax refund online. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. Update on the Federal Unemployment Benefits Deduction for Taxpayers Who Filed Prior to the Enactment of the American Rescue Plan Act. To submit your quarterly tax report online please visit httpsthesourcejfsohiogov.

Due to the ARPA the IRS is allowing certain taxpayers to deduct. Under the American Rescue Plan individuals who received unemployment. JFS-20106 Employers Representative Authorization for Taxes.

Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. Please do not submit an Ohio ID theft affidavit IT TA with ODT for this reason unless a fraudulent income tax.

You can also call the departments individual taxpayer. Changes in how Unemployment Benefits are taxed for Tax Year 2020. Mike DeWine signed a state law on.

Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. Ohio unemployment income tax refund Tuesday May 10 2022 Edit. Unemployment compensation is intended to provide benefits to employees who lose their jobs through no fault of their own.

Here is more information about unemployment. I filed as single. On April 6 2021 the Department of.

Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. I filed my taxes in March before the 10200 tax break with turbo tax. The change in a bill signed by Gov.

Mike DeWine Wednesday brought Ohio in line with federal tax law. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. I was wondering if anyone received their additional refund yet.

Due to the Federal American Rescue Plan Act of 2021 signed into law on March.

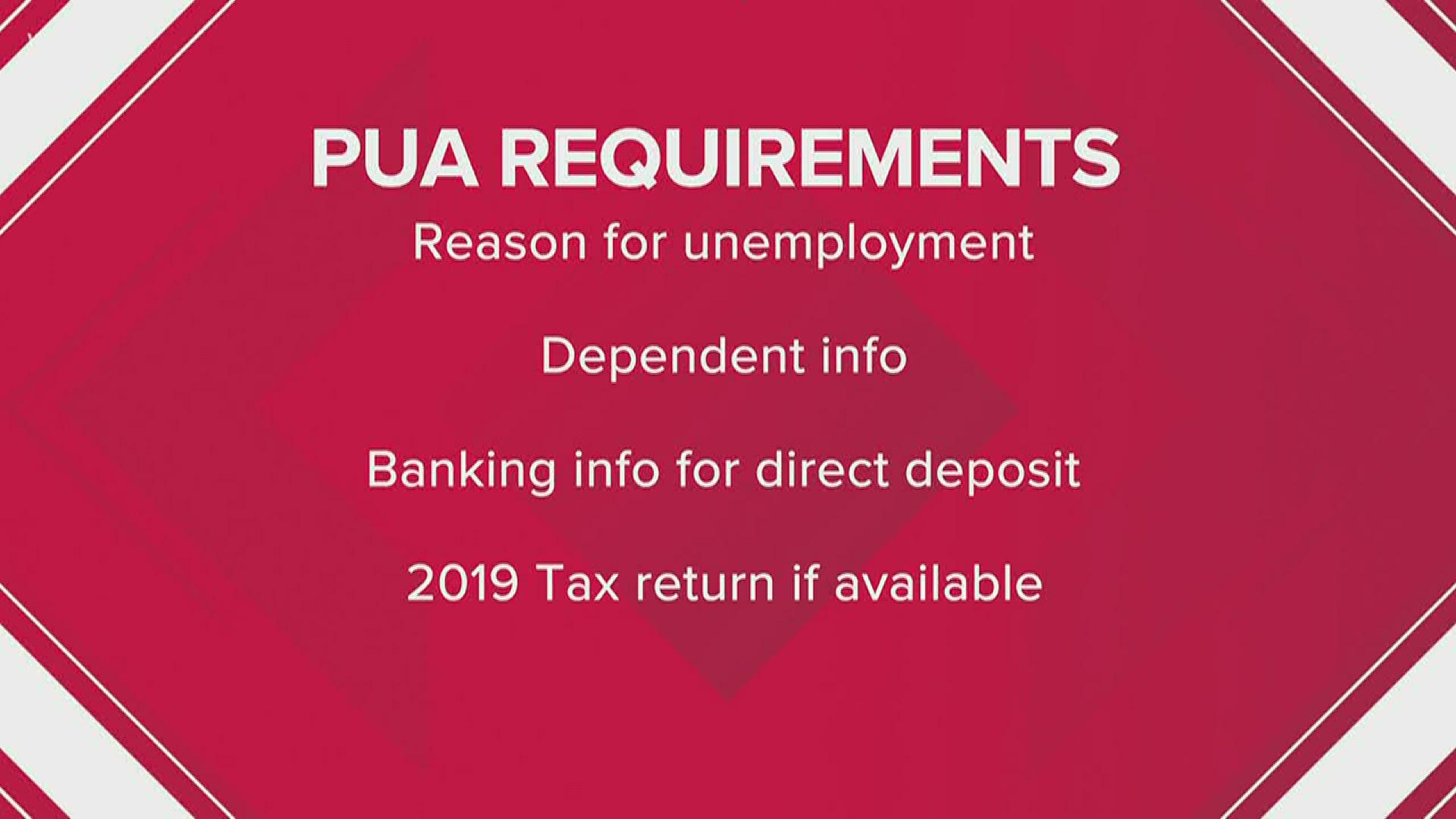

1099 Self Employed Part Time Workers Can File For Unemployment Wtol Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Income Tax Preparation Services Akron Ohio 1040 1065 1120

Blog Billings Company Cpas Accounting Tax Elyria Oh

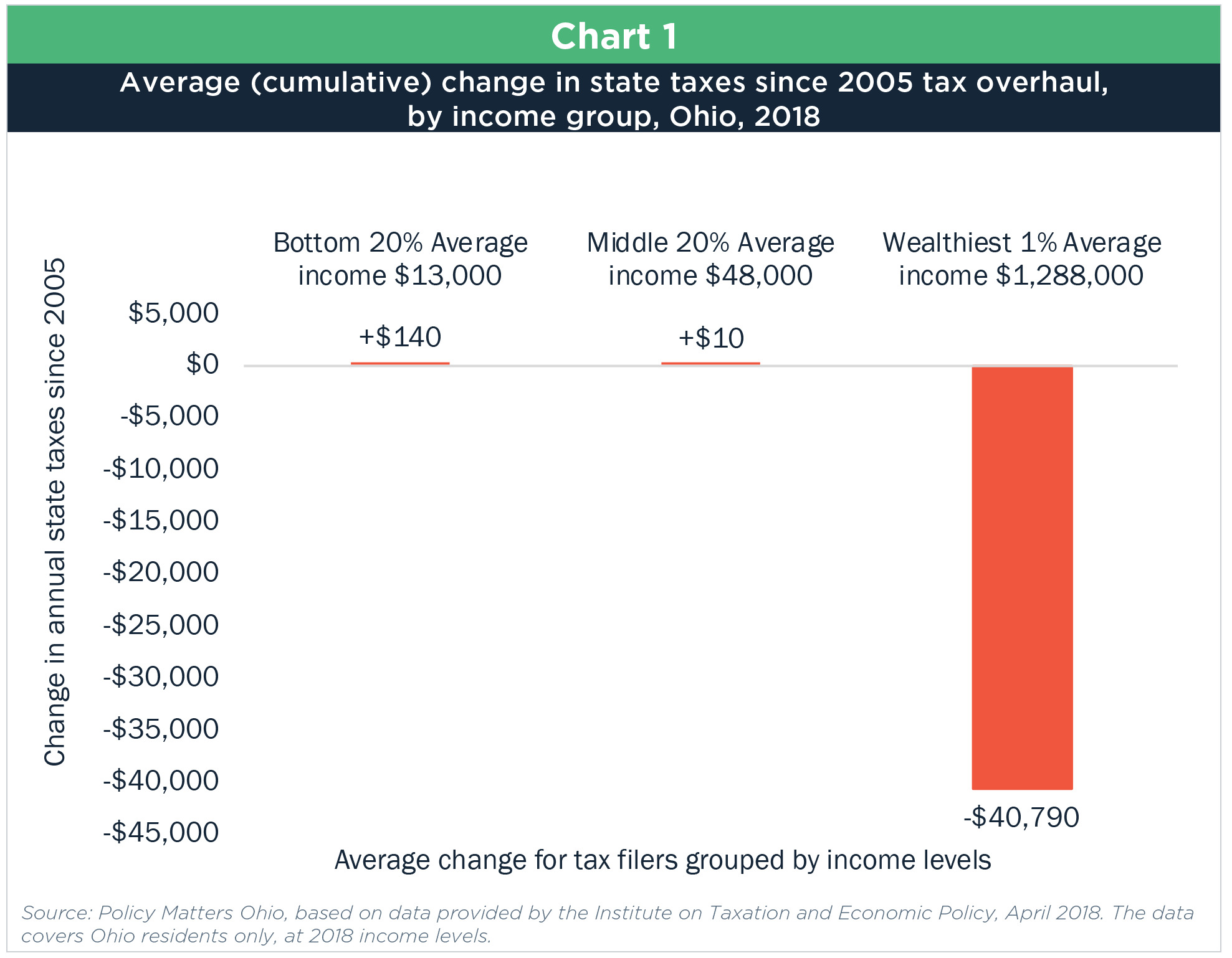

Overhaul A Plan To Rebalance Ohio S Income Tax

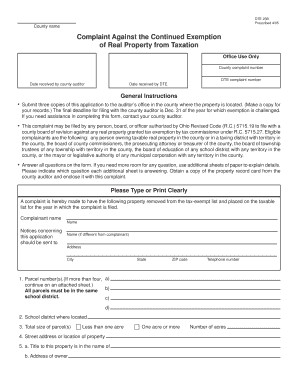

Ohio Unemployment Ein Number Fill Online Printable Fillable Blank Pdffiller

Surprise Tax Forms Reveal Extend Of Unemployment Fraud Omaha Daily Record

2021 Unemployment Benefits Taxable On Federal Returns Wkyc Com

1099 G Unemployment Compensation

Income General Information Department Of Taxation

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund Update What Is Irs Treas 310 10tv Com

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Is Unemployment Taxable In Ohio Taxation Portal

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Will My Unemployment Benefits Affect My Tax Refund Gudorf Tax

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits